Protest Your 2026 Hays County Property Taxes

Expert Hays CAD Protest Services - No Upfront Fees, Pay Only If We Win

We handle your Hays CAD protest from filing to hearing. You only pay if we reduce your taxes.

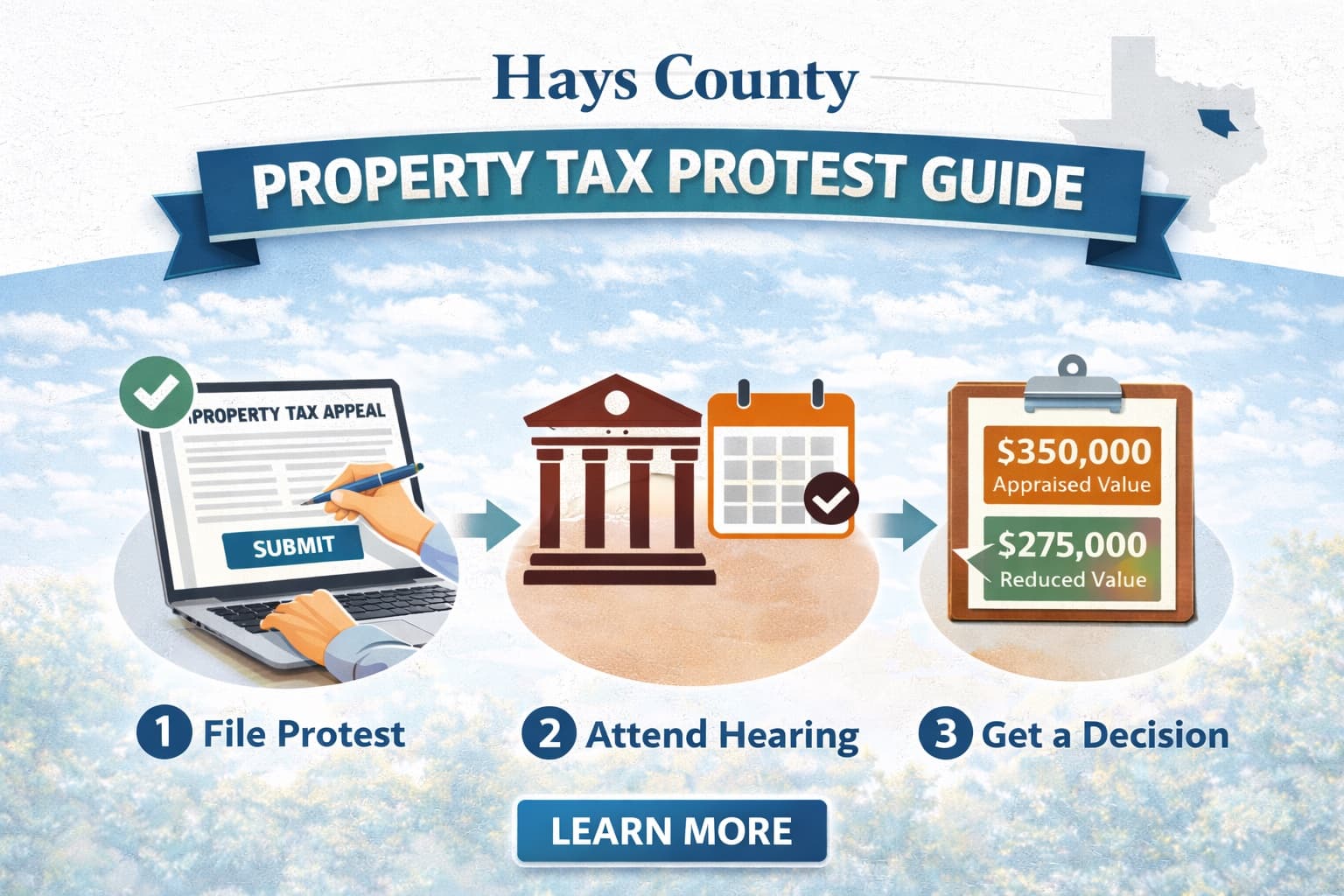

How to Protest Your Hays County Property Taxes

We Handle Everything

We research your property, gather evidence, and present your case at hearings with Hays CAD.

Results

You receive notification of your final assessed value and updated tax bill.

Benefits of Protesting Your Hays County Property Taxes

Beat Tax Value Increases

With rapidly inflating home values, if you're not protesting, you're paying more than your fair share in property taxes.

Save Time, Save Money

We handle the entire process for you - filing your protest, crafting your unique case analysis and fighting to reduce your tax burden.

Sign Up Risk Free

No credit card required. No service fee until after you've saved money. If there is no reduction, our services are free.

What Hays County Homeowners Say

See why homeowners trust us to handle their Hays CAD property tax protests.

“This was such a simple and successful process, and I can't recommend Ballard enough if you're looking to protest your property taxes. Everything was done virtually, and I was informed on each step of the process via email.”

“For the second year in a row, Ballard has helped us with our protest. They work quietly behind the scenes and then, voila!”

“We would highly recommend Ballard's services for effectively protesting a property's market & appraised values. They were professional and timely with communications, and successful in conducting our protest.”

Areas We Serve in Hays County

We help homeowners throughout Hays County reduce their property tax burden. Whether you live in a major city or a smaller community, we can represent you.

Hays County Property Tax Calendar

Important dates for the 2026 Hays CAD property tax protest season.

Hays CAD mails appraisal notices to property owners

Deadline to file property tax protest

Informal hearings with Hays CAD appraisers

Appraisal Review Board (ARB) hearings

Tax bills mailed by Hays County Tax Office

Property tax payment deadline

Hays County Property Tax Protest FAQs

Get answers to common questions about protesting your Hays CAD property tax assessment. For more detailed information, visit our comprehensive FAQ page.

Why should I protest my Hays County property taxes?

Protesting gives you the opportunity to lower your assessed value and reduce your tax bill. Hays County is one of the fastest-growing counties in Texas, located between Austin and San Antonio. Cities like Kyle, Buda, and San Marcos have experienced explosive growth. Property values have risen dramatically. Even if you think your assessment is fair, it's worth protesting - many Hays County homeowners receive reductions each year.

How much does it cost to protest with Ballard?

Nothing upfront. We work on a contingency basis - you only pay 1% of your assessed value reduction if we successfully lower your property taxes. If your value isn't reduced, our services are completely free. No credit card is required to sign up.

What information do you need to file my protest?

Just your authorization. When you sign up, you'll complete a simple agent designation form that allows us to represent you with Hays CAD. We handle everything else: filing the protest, gathering evidence, and presenting your case.

What is the deadline to protest in Hays County?

The standard deadline is May 15, 2026, or 30 days after your appraisal notice is mailed - whichever is later. If you miss the deadline, you cannot protest your assessment until the following year. We recommend signing up as early as possible.

Can I protest if I already protested last year?

Yes! You should protest every year. Property values change annually, and so do market conditions. Even if you received a reduction last year, your value may have increased this year. Consistent protesting is the best way to keep your taxes as low as possible.

What happens at an informal hearing with Hays CAD?

At the informal hearing, we meet with a Hays CAD appraiser to discuss your property's value. We present comparable sales data and other evidence supporting a lower value. The appraiser reviews the evidence and may agree to reduce your assessment. Most protests in Hays County are resolved at this stage.

What if the informal hearing doesn't reduce my value?

If we can't reach an agreement at the informal hearing, we proceed to the Appraisal Review Board (ARB). The ARB is an independent panel that hears evidence from both sides and makes a binding decision. We represent you at the ARB hearing at no additional cost.

How long does the Hays County protest process take?

The timeline varies, but protests are typically resolved within 2-4 months after filing. Hays CAD holds informal hearings in June-August, with ARB hearings scheduled through September if needed. We keep you updated throughout the process.

Will protesting increase my taxes next year?

No. Protesting cannot increase your current year's assessment, and it doesn't flag your property for higher values in future years. Hays CAD appraises all properties annually regardless of whether you protest.

Do I need to attend any hearings?

No. As your authorized agent, we attend all hearings on your behalf. You don't need to take time off work, prepare evidence, or appear before the ARB. We handle everything and notify you of the results.

Hays CAD Contact Information

Hays County Property Tax Statistics

Key data points for Hays County homeowners considering a property tax protest.

Data from 2024. Sources: Hays CAD, Texas Comptroller, Zillow.

Want to understand these numbers better? Read our complete protest guide or learn how comparable properties affect your taxes.

Why Choose Us for Your Hays County Property Tax Protest

We don't just file protests with Hays CAD; we study the data and discover new ways to save our clients money. We are always updating our technology to feature the latest in protest software and have implemented a results-based business model.

SEE HOW IT WORKSTexas Property Tax Protest Resources

Learn more about the property tax protest process in Texas with our comprehensive guides.

Texas Property Tax Protest Guide

Complete guide to protesting your property taxes in Texas, including deadlines, evidence tips, and the ARB hearing process.

Read the guide →Compare Property Tax Protest Companies

Compare Texas property tax protest companies by fees, services, and what to look for when choosing representation.

View comparison →Hays County Resources

Learn more about property taxes in Hays County with our latest articles and guides.

Hays County Property Tax Rate: 2025 Rates by Taxing Entity

Hays County property tax rates total approximately 2.15% for Kyle homeowners. See the full breakdown by taxing entity and how to lower your bill.

Read more →

Hays County Property Tax Protest Deadlines and Evidence Tips

Learn the Hays County protest deadline, how to file with Hays CAD, and evidence tips to win in San Marcos, Kyle, and Dripping Springs.

Read more →

Hays County Property Tax Protest Guide

Protest your Hays County property taxes before the deadline. Learn how the Hays CAD protest process works or let experts handle it. No reduction, no fee.

Read more →Property Tax Protest Services in Nearby Counties

We also help homeowners in neighboring counties reduce their property taxes. View all Texas counties we serve.

About Hays County Property Taxes

Hays County is located in the Texas Hill Country between Austin and San Antonio, and is one of the fastest-growing counties in the nation. With a population exceeding 260,000 residents, the median home value is approximately $390,000, and at an effective tax rate of about 1.97%, the typical homeowner pays roughly $7,685 per year in property taxes - among the highest in the state. The Hays Central Appraisal District (Hays CAD) appraises all property in the county annually. In 2024, nearly 44,000 property tax protests were filed - an impressive 35% of all parcels, one of the highest protest rates in Texas. Of those protests, 80% resulted in a reduced value. At the ARB level, 78% of cases still result in reductions. Hays County experienced one of the sharpest market corrections in Texas, with property values declining 9.1% year-over-year in recent data. Despite this significant decline, assessed values often lag behind the actual market, meaning many homeowners are still paying taxes on values from the peak of the market. The county is home to Texas State University in San Marcos, and the rapidly growing cities of Kyle, Buda, and Dripping Springs continue to attract new residents. With more than a third of Hays County property owners already protesting each year, the data is clear: protesting works, especially in a declining market where assessed values haven't caught up to reality.

For official property tax information, visit the Hays CAD website or the Texas Comptroller's Property Tax page.

Have questions about the protest process? Visit our FAQ page or contact us directly.

Ready to Lower Your Property Taxes?

Get started today. We'll handle your Hays County protest from start to finish.

START YOUR PROTEST